Business overview :

- Remember that drone in ‘3 idiots’ in 2009. Well, it was created by the founders of IdeaForge which has emerged as a leading market player in the Indian drone industry.

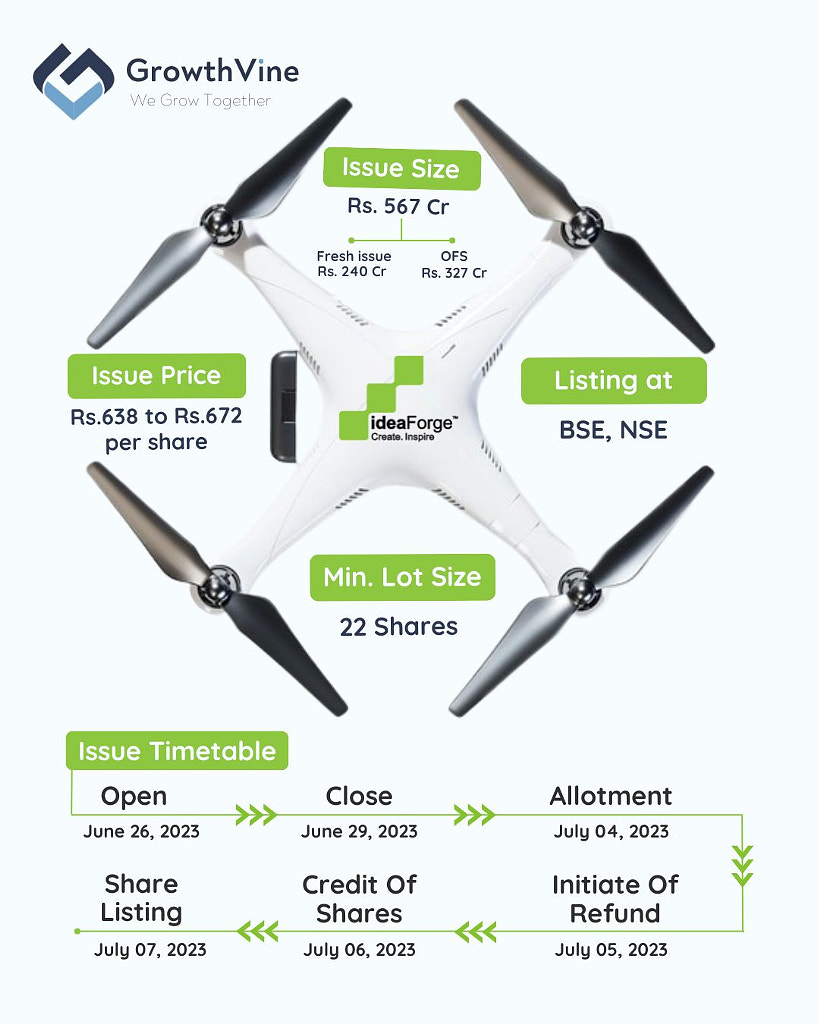

- The company is opening up for its 567 cr IPO, giving Indian public an opportunity to invest in India's pure-play drone manufacturer.

- ideaForge has a 50% market share in Indian Unmanned Aircraft Systems (UAS) market.

Industry overview :

- The current global drone industry market size is $21bn, which is expected to grow at 20% CAGR to reach $91bn market.

- The Indian drone industry is very nascent and is only valued at $43mn currently. But it is expected to grow at 80% CAGR to reach $812mn in next 5 years.

- Current use cases are majorly in defence, but logistics is expected to be the biggest market by 2030.

Growth drivers :

- Easing of regulations and incentivisation through PLI scheme will lead to increased adoption of drones.

- Introduction of new use cases across industries such as agriculture, mining, logistics etc.

- As the drone usage increases, software and services for drone will also pick up.

- Increased demand for drones for monitoring and surveying with its low operational costs and higher environmental friendliness.

With the drone industry expected to explode in the future, let's look at the prospects for ideaForge in this industry.

Idea forge's USP :

ideaForge is a market leader in Indian UAS market with following strengths:

- One of the most diverse product portfolios in India along with in-house developed software stack.

- In-house manufacturing facilities.

- Well qualified and experienced management team.

- Higher spending on R&D which is going to be the key in this advanced tech market.

The company's investments into R&D can also be understood from the fact that company has 116 employees in product development which is 40% of total employee strength.

Competition :

The competition intensity is going up in this sector with the easing of regulations and incentivisation through PLI schemes which has led to a huge number of drone startups in last 2 years.

Let's have a look at some of the competitors from the listed space:

| FY23 | ideaForge | Hindustan Aeronautics | Bharat Electronics | MTAR Technologies | Astra Microwave Products | Data patterns |

| Revenue From Operations | 1,860 | 2,69,274.6 | 1,77,344.4 | 5,738 | 8,155 | 4,535 |

| Revenue CAGR (FY20-23) | 136.9% | 7.9% | 11.0% | 39.0% | 20.4% | 42.7% |

| Gross margin | 68.4% | 62.5% | 44.6% | 53.0% | 36.4% | 62.3% |

| EBITDA margin | 25.3% | 24.8% | 23.0% | 26.8% | 18.1% | 37.9% |

| PAT margin | 17.2% | 24.2% | 16.8% | 18.0% | 8.6% | 27.3% |

| ROCE | 10.4% | 13.5% | 24.5% | 18.7% | 17.2% | 12.5% |

- None of the competitors are pure-play drone players and hence are not directly comparable.

- ideaForge has very good gross margins because of fully-integrated processes and in-house manufacturing facilities.

- ROCE looks depressed because of higher capital intensity in the business.

Financials :

| Rs. Mn | FY21 | FY22 | FY23 |

| Revenues | 347.2 | 1594.4 | 1860.1 |

| EBITDA | -92.5 | 751.3 | 574.9 |

| EBITDA Margin | -26.6% | 47.1% | 30.9% |

| PAT | -146.3 | 440.1 | 319.9 |

| PAT Margin | -42.1% | 27.6% | 17.2% |

| Orderbook | 1364.0 | 3108.8 | 1922.7 |

- Revenues have grown massively in last 2 years because of 2 big orders from Indian Army.

- The company has turned profitable but margins have declined in FY23 from FY22 with raw material prices going up as well as investments in product development.

- Decent orderbook size does provide some visibility to revenues in short term but there is a lot of lumpiness in the business.

| Revenue break-up | FY21 | FY22 |

| Civil | 86% | 20% |

| Defence | 14% | 80% |

The revenue contribution from defence has gone up in last 2 years because of big orders from Indian Army.

Risks :

The company has fairly long cash conversion cycle, which puts pressure on cash flows and constant need to fund big orders.

| FY 21 | FY 22 | FY 23 | |

| Cash conversion cycle data | 622.1 | 413.3 | 675.9 |

- The business is very lumpy and if big orders are not renewed can be extremely detrimental to the revenue growth.

- Deep pocketed competitors like Adani and other players can be challengers.

- Huge regulatory or policy risk.

- This is a high tech sector and there is a very high event risk (blow ups in sensitive areas) and obsolence risk.

Valuation :

| ideaForge | DroneAcharya | |

| P/E | 82x | >100x |

| P/S | 15x | 10x |

- The company is expensive when looked at from traditional valuation frameworks. There is also a scarcity premium being charged for the only pure-play listed drone company in India.

- However, we feel that valuations are not a big risk in this as the company is operating in a very high growth market. The biggest risk for ideaForge would be non-renewal of big order from Indian Army.

DISCLAIMER: This blog is solely for educational purposes and not to offer any investment advice. Please do your own research or consult a financial advisor before making any investment decisions.

Comments